Classic loan calculators that you can find on most finance or bank websites offer you only limited functions. Basically you can choose loan amount, add interest rate and set loan term and the calculator will tell you how much your weekly, fortnightly or monthly repayment will be.

What you cannot do is doing some more in depth analysis and modelling. For example you cannot keep adjusting your payment amount or payment frequency to see what the effects on the total loan term will be.

![]() Loan Repayment & Mortgage Amortization Schedule Calculator in Excel will allow you to do all these things and much more!

Loan Repayment & Mortgage Amortization Schedule Calculator in Excel will allow you to do all these things and much more!

Download free version of the calculator: click here

Buy premium version of the calculator: click here

Update, April 24th, 2013:

We upgraded this calculator recently and added few more handy features. To see what’s new, check this post.

Benefits and what you can do with it:

✔ Calculate amortization schedule for any loan amount

✔ Principal, Interest and Total Repayment amounts breakdown

✔ Know exactly how much principal you owe at any point in time

✔ Suitable for any loan type – mortgage, personal loan or hire purchase

✔ Choose daily, weekly, fortnightly or monthly payment frequency

✔ Choose daily, weekly, fortnightly or monthly interest compounding frequency

✔ Daily repayments give you up to 7 years of amortisation schedule

✔ Weekly repayments offer up to 50 years of amortisation schedule

✔ Fortnightly repayments for up to 100 years maximum loan term!

✔ Not enough? Ask us and we will extend it for you!

✔ Add any number of extra payments at any times throughout the loan

✔ Set any interest rate that automatically adjusts to the payment frequency

✔ Easy to re-create any schedule, even one that starts in the past

✔ Daily interest rates automatically applying 365 or 366 days per year

✔ Audit your bank if they charge correctly or are cheating on you

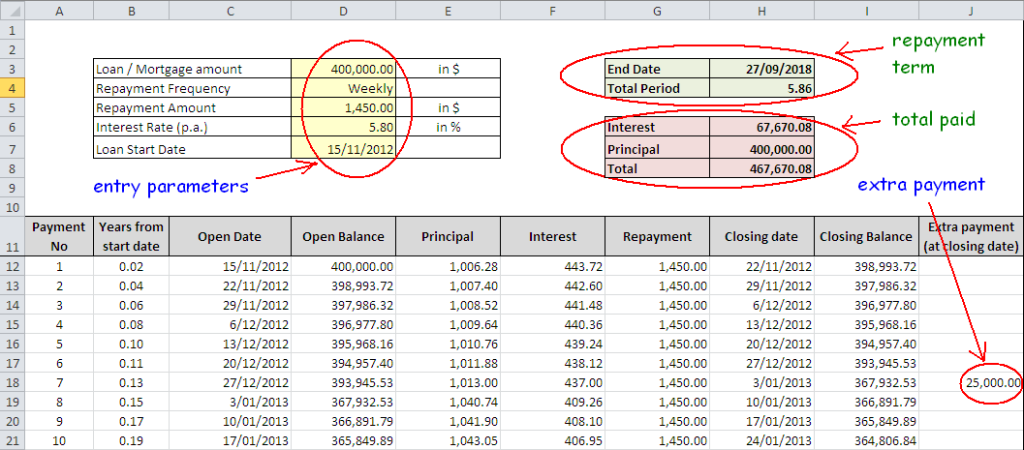

After feeding all the entry data, the calculator immediately shows you the results.

Calculation Results:

✔ Total length of loan term in years

✔ Date of the last payment

✔ Total amount of principal, interest and repayments paid

✔ Detailed amortization schedule

Have you ever been in a situation when you wanted to take another loan? Then your bank asked you how much you owe on other loans but you couldn’t answer because you simply didn’t know?

Well, now with our calculator you will have the exact overview about any outstanding amount owed at any given time!

On top of that, before taking out the loan you will be able to calculate for yourself in advance how much you can afford to borrow, what your repayments are and how long it will take to pay it off.

You will also know how any extra repayments influence (shorten) the total time needed to repay the loan in full. These extra repayments can be any bonuses or dividends you receive and then put against your loan.

User Manual

1. Enter entry parameters into the header area

2. Amortization schedule is populated immediately. Now enter any extra payments

3. Review the results for repayment term and total paid straight in the header next to the entry parameters.

4. Play with it, change parameters and perform data modelling until you are satisfied with the result

5. Print the schedule.

Note 1: The schedule will automatically fit your printer width. However, the spreadsheet is quite long, pre-populated with formulas. To avoid printing blank pages (hidden formulas) just check which is the last page containing some data and set the print range accordingly.

Note 2: If you key in the entry parameters and the amortization schedule is showing some nonsensical data (negative principal values), it means that your nominated repayment is too low and does not cover even the interest. In such case you need to increase the repayment amount.

Do you like our calculator? We would love to hear your feedback and any suggestions to improve it even further. Please let us know in the comments below!

I just purchased the Premium Excel Calculator. I am issuing a Promissory Note of $150,000.00 with a

7.5 % p/a compounded yearly for 10 years term. I am not able to input that yearly compounded interest.

When I input the monthly compound and I filled in the monthly payment, the result was way off.

But when I put $0.00 for the monthly payment, wow the total amount included interest matches with my

raw calculation for monthly compound interest total.

Please explain and help with yearly compounded interest !!!

Thank you

If you don’t want to use interest compounding frequency, you can overwrite the formula in field G18 to:

=((D18-D17)/365)*($E$11/100)*E17

If you are using an upgraded version of the calculator then overwrite field G20 to:

=((D20-D19)/365)*($E$13/100)*E19

And then copy the formula to the rows below.

Hi I bought the loan schedule premium a few months ago and wonder if you have another calculator that has columns for taxes and for insurance also? Can this one be modified to include that? Could I put the taxes and insurance in the extra payment column as a negative amount and would the balances be correct? Thanks for any info.

Hi Will, unfortunatelly we do not have a calculator that includes tax or insurance. Tax and insurance are not part of loan calculators because they are paid to different organisations and do not affect the loan balance. However, if you wish, you may modify the calculator to meet your needs just as any other Excel spreadsheet.