This advanced Excel calculator is designed to simultaneously manage Amortization Schedules for Multiple Loans. As you know, in most cases people as well as businesses don’t have just one loan.

However, if you are looking for a great calculator for only one loan (or mortgage) then instead of this one we recommend using this: Excel Amortization Schedule Calculator for Loan Repayments.

It has some additional features (like extra repayments or interest compounding options) which are not included in the Multiple Loan Calculator.

Managing Multiple Loans in One Excel Spreadsheet

An average consumer usually maintains multiple loans in parallel. When the number of loans gets bigger than 2 or 3, managing all repayments can be quite challenging.

Our new calculator should help you get on top of your loans.

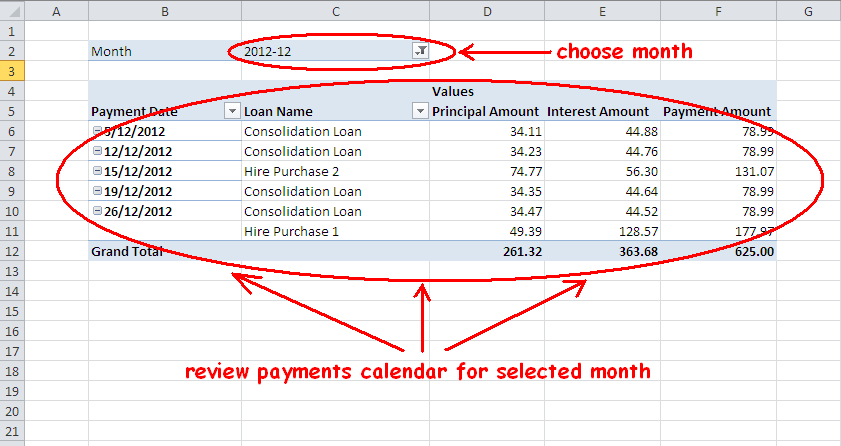

It will enable you to generate clear and easy to read repayments calendar. That way you will never ever overlook or miss a single loan payment. Off course, assuming that you have enough money available in your bank account.

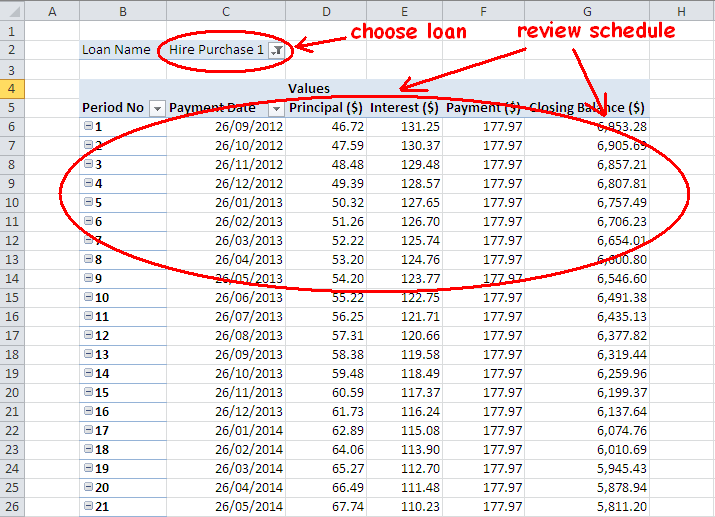

Our Excel calculator has a form of amortization schedule which splits the repayment amount into two main parts – interest and principal.

This calculator also gives you visibility over all loans periods separately and combined as well. That way you should see exactly how much will be your repayment, interest and principal amounts.

It will greatly help you with your advance cash flow planning. Next, you should be able to identify periods when total repayments get higher than usual and prepare you for such event accordingly.

![]() With Our Excel Calculator for Multiple Loans you will be able to do all the things above and much more!

With Our Excel Calculator for Multiple Loans you will be able to do all the things above and much more!

Download Demo Version: click here

Buy Full Version: click here

Benefits and things you can do with it:

✔ Calculate amortization schedule for multiple loans at once

✔ Breakdown of Repayment amount into Principal and Interest

✔ Know exactly how much principal you owe for each loan at any time

✔ Know exact date when you become debt free

✔ Easy planning and modeling your loans

✔ Project your cash flow years in advance

✔ Supported loan types – car loans, personal loans or hire purchases

✔ Can be used for mortgages as well

✔ Repayment frequency: weekly, fortnightly and monthly

✔ Calculate schedules for up to 30 parallel loans (easily add even more)

✔ Number of combined repayment periods available: 8000

✔ Enough for 10 loans x 15 years x 52 weeks/year = 7800 (or 30 loans x 20 years x 12 months = 7200 repayment periods)

✔ Set individual interest rate (p.a.) for every loan

✔ Set any start date for each loan, even in the past

✔ Recreate amortisation schedules for already running loans

✔ Find out if your bank charges you correct interest rates

After keying in all the entry data, you can see the result immediately.

Calculation Results:

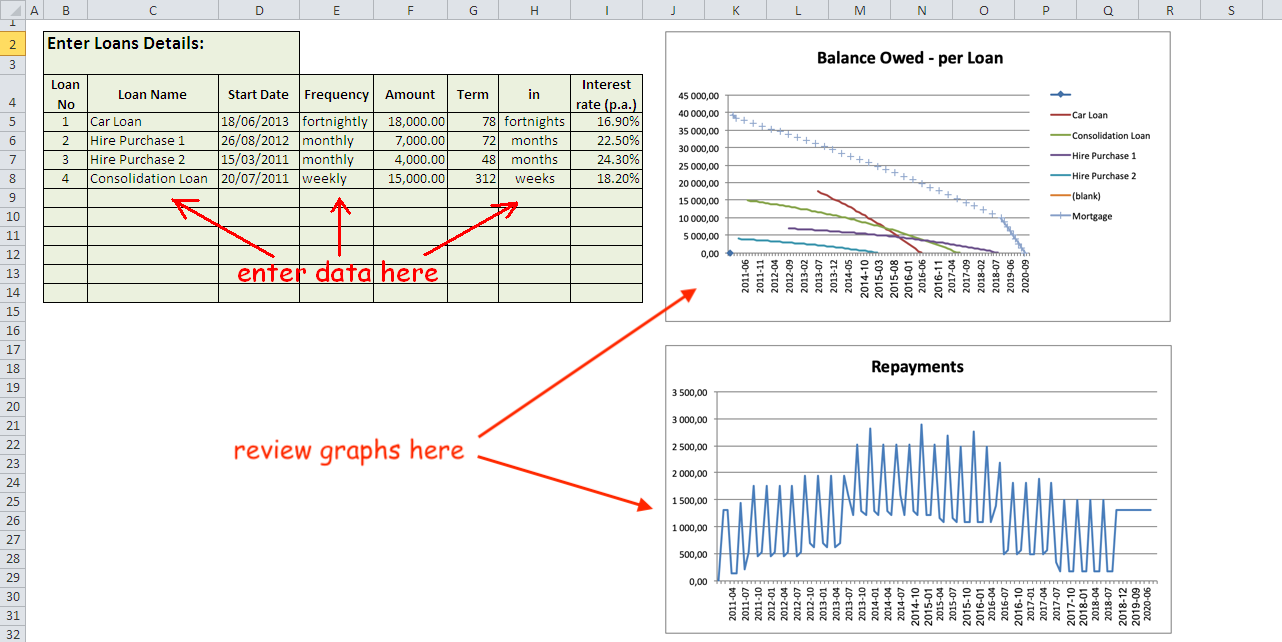

✔ Graph with combined monthly repayments throughout the whole term

✔ Graph with individual loan balances owed through loan life cycle

✔ Graph with combined loans balance owed through entire period

✔ Detailed amortization schedule for each individual loan

✔ Monthly repayments calendar (extendable to any length)

With this excel calculator you will know exactly how much you owe (loans principals) at any given time. You will also know exact amounts of your combined monthly commitments throughout the entire loans term.

Before you decide to take out any new loan, just enter its details into your existing loan portfolio. You will immediately see how it affects your future cash flow.

Our Excel calculator for Multiple Loans will give you answers to following questions:

1. Can you really afford any extra loan? If so, how big?

2. How long before some of your existing loans expires and releases available cash flow for a new loan?

3. Will there be any months when loans with different repayment frequencies combine and put an extra demand on your outgoing cash flow?

4. When will you become debt free?

5. How any new loan will impact your ability to meet repayments?

6. How will any additional loan extend the period before becoming debt free?

7. How much interest on top of principal will each loan cost you?

User Manual

There are three spreadsheets within the Excel workbook:

1. Entry data (and Graphs)

Note 1: Once you enter all loans parameters, click on Data -> Refresh button to recalculate the results.

Note 2: Please follow the default layout for entry parametrs. Also, use loan numbering from 1 to 10 sequentially in ascenting order. For no loans leave all fields empty. Any deviation from default format may cause the calculator to not function properly.

2. Loan schedule

3. Repayment calendar

We would love to hear your feedback about this calculator. If you have any comments, suggestions for improvements or if you find any error in the calculator, please do let us know. We truly appreciate your valued opinion.

Hello,

I am holding a mortgage for a relative that misses a lot of payment and pays late and odd amounts. Do you have an amortization schedule that would help me fairly track his payments and interest? He doesn’t pay according to his schedule at all, and I don’t know how to manage it fairly.

I would recommend this loan calculator: https://www.unclefinance.com/ultimate-loan-mortgage-amortization-calculator-in-excel/

Hello,

After inputting new data into the first worksheet, the data refresh option isn’t available, its grayed out. What should I do?

When you open a new Excel file on your PC, the Excel sometimes wants you to accept the file. It shows a bar under the Menu. You just need to click “OK” or “Accept”.

I have 4 loans that I would like to apply a fixed amount continually until all are payed off, Example:

Loan 1,2,3 are all lower interest and will take 2 year to pay off. Loan 4 is high interest and I am paying off fast at $400 per month and will be payed off in 9 month.

I would like to reapply the now available $400 / month to one of the other 3 loans a 2 or 3 to speed up their repayment schedule.

I would like to do this until all the loans are payed off with the fixed amount available every month.

Is there a way to edit this spreadsheet to accomplish this?

Dave

Hi Dave, thanks for your question.

This calculator is not designed for changing repayments mid-term. All loans have to follow standard repayment schedule. You can try to modify the calculator if you wish, but you will be on your own. We are not offering custom modifications. We sell this calculator “as is”.

Maybe this would be a better suited calculator for your purpose:

https://www.unclefinance.com/ultimate-loan-mortgage-amortization-calculator-in-excel/

However, the other calculator is just for one loan, so you would have to calculate 4 loans separately.

I just purchased the sheet. How do I use it for credit cards?

You can use it for credit cards the same way as any other loan, assuming you will make equal repayments every month.

Hi

I’m looking to do this for approximately 1000 loans, for business purposes.

Do you have a sheet for that many loans?

This spreadsheet can theoretically handle even 1000 loans, but calculating so many loans in Excel can make the spreadsheet to work extremely slowly. I would suggest searching for a special loan program or application, not Excel.

Not quite looking for 1000 but I’d like to build beyond the 30 and want to confirm that the purchased edition can be added to and the workbook would have full access to all formulas and sheets. I’d like to potentially add to the entry sheet columns to add more details but maintain all that is existing. I may want to build addition tables or graphs off the data. This sheet is great and exactly what I was envisioning!

Yes, in the purchased version you have full access to all sheets and formulas. There is one hidden sheet containing calculations, but you can easily unhide it (by right clicking on any sheet and choosing “unhide”).

Thank you! This will be a great document, worth its value multiple times over.

Is it possible to take the features of the Ultimate loan calculator, where you can adjust the amortization schedule. Then incorporate that into the Multiple Loan calculator? That would be amazing if you could possible create such a calculator. I have multiple loans, and I have probably never made a payment on the actual due date. I typically pay well before it’s due, and I am ahead on most of my bills. I also pay extra. I would like to utilize the graphing capabilities of the multiple loan calculator to figure out which loan would be best to pay off early. Then with that loan paid off, I would like to add the money that I am not longer paying on that paid off loan every month, to one of my other loans to pay that one off early too. I hope to utilize that to minimize my interest and loan lengths efficiently.

Hi Terron, this would be too complex for an Excel streadsheet. This kind of functionality may be availabe in special credit/loan programs or applications. Try to look in this area.